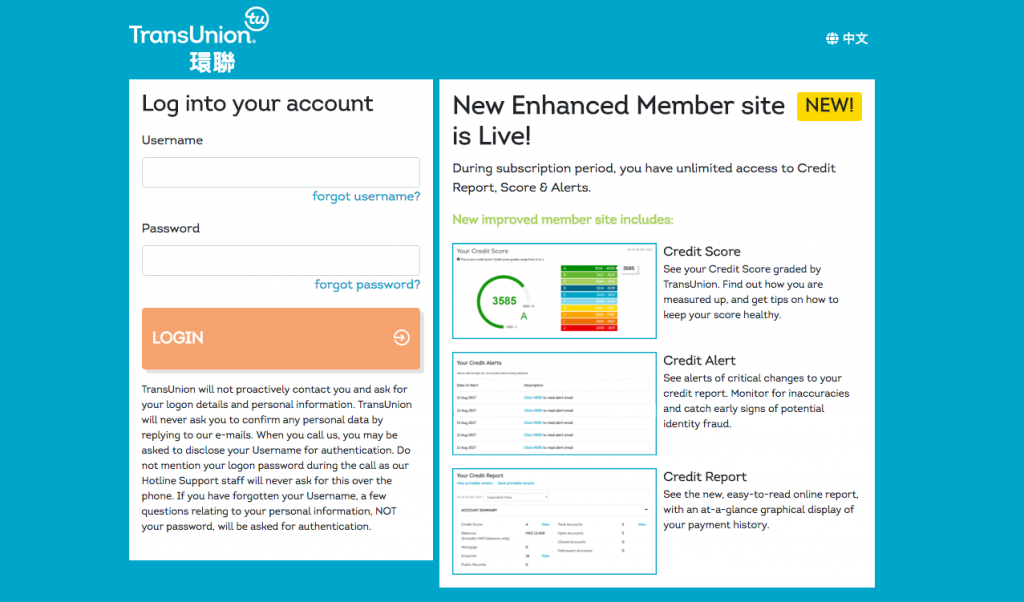

I am very worried that Transunion Hong Kong’s site (transunion.hk) has been hacked because my original login and password no longer work and also the forgot password function does not work.

transunion accounts all locked out

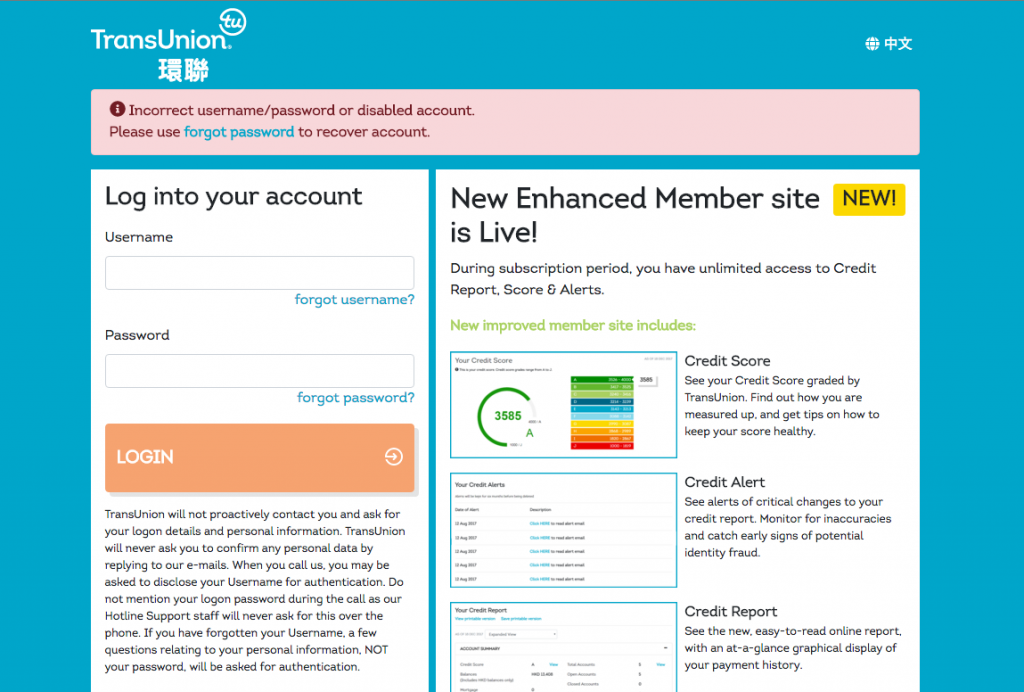

After entering the correct login and password, I get this screen:-

transunion hong kong locked out

It’s quite possible that their site has been hacked since there was no notification to users that all of their login / passwords have been changed. I had used the correct login and password to login and I had previously been successful in logging in but as of today (4 August 2018) the login and password seized to work. Transunion Hong Kong did not contact me about the fact that they had changed my login and password at all so I can only come to the conclusion that either their site had probably been hacked and the hacker had tampered with all user’s logins and passwords.

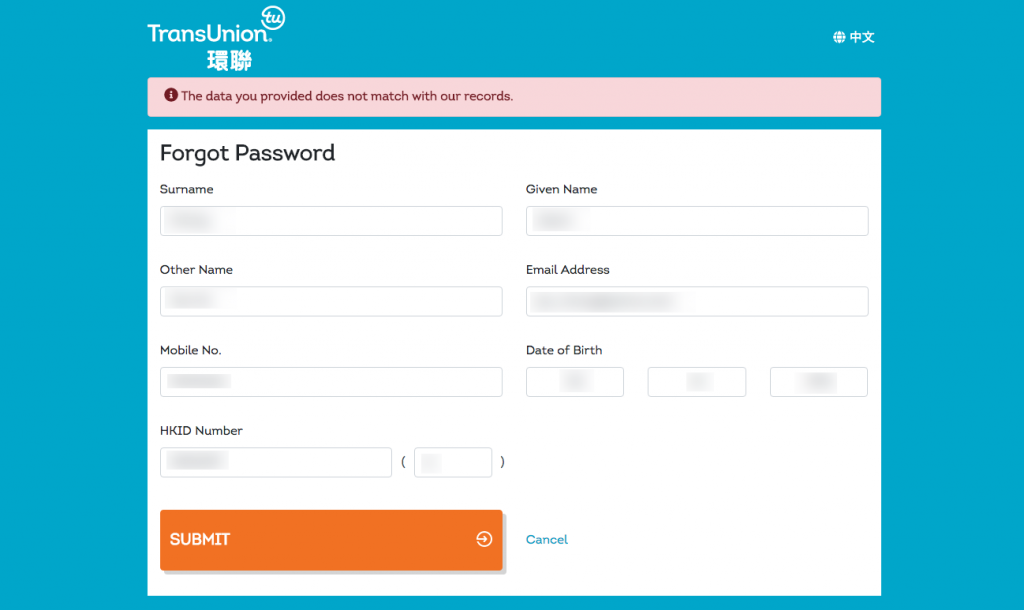

I filled in all of my personal details and was returned with the following:-

transunions hong kong probably hacked

With no means of contacting them; I wrote to them by email and didn’t get a reply. I called them on +852 2577 1816 and couldn’t get through to anyone.

It is very troubling that Hong Kong people’s sensitive data are being handled by such an unprofessional team of amateurs. Nothing on the site works and I think Transunion owes the public an apology for this complete screw up.